As an accountant or bookkeeper, you’d know that a supplier must give you an ABN or you must withhold PAYG at 47%.

How often do you check the ABN records of suppliers?

When was the last time you checked they were active and the GST status was correct?

The reality is these details should be checked before every payment; despite the process only allowing you to check one ABN at a time. But, is this a realistic practice for busy accountants and bookkeepers when there’s only so many hours in a day?

In the pursuit of finding a solution, I have been working with sixty:forty to develop various compliance tools to make life as an accountant or bookkeeper easier.

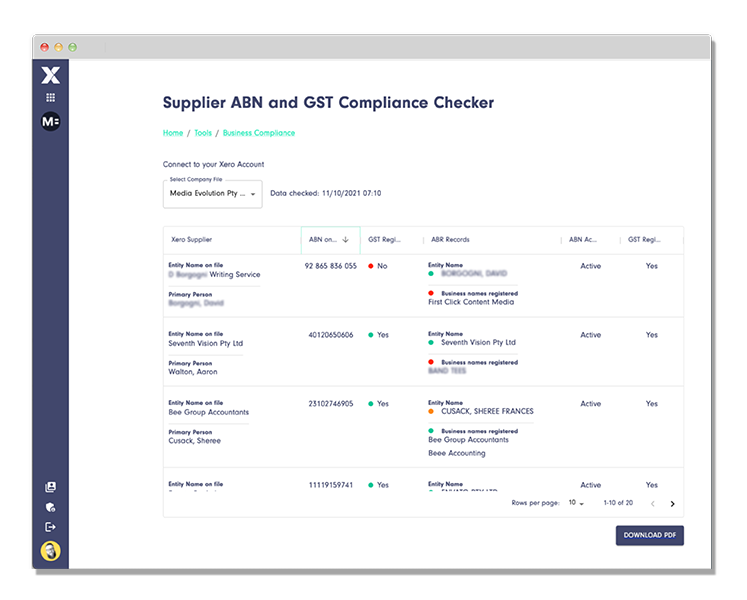

The first tool we are releasing is a taxation compliance tool: ABN & GST Checker.

This new tool means you no longer have to go through the long-winded task of checking individual ABNs.

The business owner is ultimately responsible for checking the ABN validity of their supplier before payment. Where the supplier doesn’t have an ABN or it’s no longer active, you need to withhold. It’s as simple as that.

The good news is our new ABN & GST Checker makes checking bulk ABN records simple.

By building the ABN & GST Checking tool, we hope to make one step towards helping small business owners, their bookkeepers and advisors be compliant.

It is so easy to use you can run it before the creditor payment runs for the week.

Note: There are certain suppliers that are not required to quote an ABN. In that case the supplier can give you an ATO approved form ‘Statement by Supplier for not quoting an ABN’. Once completed by the supplier, this document gets kept with your own records. This form can be found here along with the instructions for use:

https://www.ato.gov.au/forms/statement-by-a-supplier-not-quoting-an-abn/

Where can I learn more about ABN & GST requirements?

The legislative provisions are found in section 12-190 of Part 2-5 (the PAYG provisions) of Schedule 1 to the Taxation Administration Act 1953 (TAA 1953).

That section imposes an obligation on the paying entity to withhold an amount from the relevant payment where the payment is for a supply made or proposed to be made in the course or furtherance of an enterprise carried on by the supplier in Australia and none of the exceptions listed in the section apply.

If you want further, specific information on this legislation you can refer to Taxation Ruling-TR2002/9 ‘Income tax: withholding from payments where recipient does not quote ABN’:

https://www.ato.gov.au/law/view/document?docid=TXR/TR20029/NAT/ATO/00001

No Withholding. No Deduction.

From 1 July 2019, you need to meet your PAYG Withholding obligations otherwise the payment maynot be tax deductible.

The intent of the tax law amendment was to provide a greater incentive for employers and entities engaging contractors to comply with their withholding obligations.

To encourage compliance, the amendment removed the ability of taxpayers to deduct certain payments where the associated withholding obligations had not met.

These rules were brought in to crack down on the cash economy. The practical effect is that the rules are far reaching when applied to real world business transactions.

The good news is using the new ABN & GST Checker makes checking bulk ABN records simple.

Importance of lodging on-time

The deduction will be denied where:

- No amount has been withheld at all; OR

- After withholding an amount, a taxpayer fails to notify the Commissioner by the due date in the approved form.

In short, there is no tax deduction where an amount was supposed to be withheld but wasn’t. Or where a withholding was made, but the Commissioner wasn’t notified by the due date.

What is an approved form for notice?

Approved form includes your Activity Statement and disclosure under Single Touch Payroll (STP) as well.

Want to try it out?

Our ABN & GST Checker tool is currently in its beta testing phase. You can trial this compliance tool by signing up here. We would love your feedback, so become a beta tester today!

Resources

https://www.ato.gov.au/general/gen/removing-tax-deductibility-of-non-compliant-payments/

https://www.ato.gov.au/Non-profit/your-organisation/dealing-with-suppliers/withholding-in-business-transactions/