The Ultimate Guide

How to Start a Business in Australia

Enter your name & email below to download your copy.

Thousands of new businesses open every day. If those people can do it, why not you?

A journey of a thousand miles begins with a single step…

There are often hundreds of thoughts that go into the decision to start a business. But nothing happens until you take that first step.

Reading through the info online makes it seem super easy to start a business. And although the process to do the basic stuff is easy, the reality is that there needs to be some structure around how you approach it.

We are pleased to share this step-by-step process that you can use to start your new small business.

To achieve success, you need to lay a great foundation. That starts here.

This guide is for general information purposes only. We always suggest checking with a professional for advice surrounding your specific purposes.

Before you rush into the legal side of starting your business, you should start by checking that you are truly ready to take that first step.

STEP ONE

Are you Ready?

It is our belief that everyone has an inner small business owner just waiting to be released.

Here at sixty:forty we want to help you start a business that has a higher chance of succeeding. Everyone’s definition of success will be different so when we say this, we mean success according to your goals.

If you want to start a financially successful small business, then this guide will introduce you to what you need to have in place to set a solid foundation for future growth.

Starting a business does require a lot of effort and commitment. We would be doing you a disservice if we told you otherwise.

Before you start, it is important to know what’s involved and to be confident that you are someone for whom self-employment can work.

Here’s a couple of questions for you to consider before you get started.

Do you have the right skills?

This might seem straightforward. You know your chosen industry and may already hold some relevant technical licences.

But running a business requires a wide range of skills. No one person can do absolutely everything. You need to have business management, finance, organisational, personal, and interpersonal skills.

A lot of these skills can be learned, but your focus should be on what it is that you do best. Your ‘secret sauce’ if you will.

- Q: Are you prepared to develop your skills and knowledge in areas that you will need to run your business?

- Q: Do you need to find someone else to work in the business, who has skills that are complementary to yours?

Are you prepared to make lifestyle sacrifices

As a small business owner, your lifestyle will change a lot. There is no such thing as work-life balance. Instead, when you run a small business, your days will become work-life integrated.

Thinking that work and life are integrated acknowledges that sometimes, you will need to work late or work on weekends. But the trade-off can be setting up your week to leave early to pick up your kids, or going to the gym.

Right at the start, the hours can be extremely long as you put everything together – without much by way of cash reward. But if you are in it for the long haul, then this is an investment in your future.

You need to ask yourself whether you are prepared to work long hours and on weekends?

And does your family support what you are doing? This is because there may be times when there is less income and less time available to spend with them.

Do you have self-discipline?

Motivation and passion can wear thin when times get tough. And feeling motivated consistently can be a struggle. You need to connect with your small business ambitions to generate the momentum to reach your vision.

Here’s a couple of questions to ask yourself:

- Q: Do you thrive in challenging environments?

- Q: Do you have the discipline and motivation to keep going, no matter the obstacles that stand in the way?

- Q: Are you happy making decisions and being held accountable for those decisions?

Do you have a money plan?

When you start a business, the costs can mount up very quickly. You need to ensure that you are in a financial position to start a business. There are many startup costs that you will need to take into account before you even start the business. You’ll also need to consider the ongoing costs involved in running a business.

It might take a little time for you to start making money, so you need to ensure you have enough savings or other forms of income so that you can continue to live.

We like asking people to think outside of the box, so don’t let a lack of cash stop you from moving forward with your idea. Instead, check out the Alternative Commerce sections on our website.

Are you prepared for the risks of being in small business?

Everything in life carries risk. Being in small business is full of risks. And one of the biggest risks could be that the business may not be successful. This might mean losing money and time.

Before you start a business, you should build an awareness about the different types of risks that you might face.

Are you prepared to be honest with yourself and accept feedback?

Honesty truly is the best policy. Being in business brings out both the best and worst in people. And not everyone is cut out to be their own boss. Only you will know whether you are or not. And to understand that, you have to be honest with yourself.

When running a business, feedback is given all the time. Sometimes this might be positive, and sometimes it is negative. How do you receive feedback? Are you interested to learn more? Or are you defensive?

Clients give feedback through their comments, their payment schedules, and their reviews.

When receiving feedback, you are ideally looking for information that will help you achieve your goals. If you make decisions based upon emotional responses to feedback, you may miss key information that could be useful in your business.

Do you have a clear vision of what being in business will mean for you?

Just what does being in small business mean for you? What will having a small business allow you to do or achieve?

Being clear on your personal goals and values is essential as the path to small business ownership begins by looking inwards – at yourself.

Your business should reflect your life purpose. That means that one of the most important things that you can do right from the start is to be clear on that purpose.

What are you most passionate about?

Understanding your deeper motivations for wanting to be in business is a great place to start understanding your key drivers. Being in business can be hard. You need to know that you will be able to keep going when the going gets tough, or when hard decisions need to be made. You can make those decisions from a place of conviction knowing that you are working towards your definition of success.

If you aren’t sure of your passion, your motivation, or your drivers for business – yeah you might end up making money. But the overall quality of your life will suffer. I mean you’ve heard of that saying – “Money can’t buy happiness”.

And it is also important to recognise that you are not your business. Your business is meant to support your lifestyle and serve the purpose of enhancing your life.

Do you have clear and measurable outcomes about what you want to achieve from owning and operating a small business?

Starting and running a small business is a major life event and for it to be sustainable it needs to meet both your business and personal objectives. Remember, this is work-life integrated. Your business should exist to serve you.

It always pays to start with the end in mind. Ask yourself to imagine where you want to see both yourself and your business or project in the longer term?

Be clear, write it all down. Build out some measurable outcomes with some hard data attached to your goals. This way you’ll know whether you are on track to achievement.

We aren’t saying all of this to put you off. We know that if you are here, you are already fairly committed to starting a new business and nothing will stop you.

So this should just be a confirmation of what you already know.

Starting a small business, or any business, can be hard. You will need to overcome any number of challenges to push forward. This requires grit, determination, and persistence.

Next Steps

In the next chapter, Chapter 2: Research Your Idea, we are going to look closely at your idea, your customers and your competitors.

STEP TWO

Research your idea

Do you have an original business idea? Have you created a brand new product? Or have you decided to turn your hobby or skill into a business? In any case, it is essential to research your idea.

It has been our experience that too many people start a business without having spent much time at all in this step. While their idea is inspired, there is often a great rush to get it to market. Yet investing in this stage is one of the wisest things you can do.

Step out of your comfort zone of friends and family and check that your idea is on the money. In this chapter, we’re going to find out how you can do your own market research so you can validate and refine your idea.

Getting too far ahead without nailing the basics can be a recipe for disaster. This means that you need to define just who is your customer and what they need to get done.

Market research can help you assess whether your business idea is viable. You can develop an understanding of your target customer, their needs, preferences, and behaviour. You will also be able to identify movements in your industry and any likely competitors.

Sound overwhelming? It’s not really. But there is a structure. Let’s look at what type of research you can do for your new business. Consider these:

Customer Research

By understanding your customer you can develop better products and services. Your customers will be spending their hard-earned money with you, so you want to identify your ideal buyer and understand where they spend their time.

Competitor Analysis

This allows you to understand your competition in depth, and helps you identify their approach to doing business with your potential customers. It provides a change of perspective – you can start to see your own business just as a prospective client would.

Now, let’s take a better look at these two points.

Understand your Prospective Clients and Customers

What comes first, the job to be done or the customer? Well, it depends on the type of business you are looking to start.

If you are looking to build innovative products, then looking at the job that you are trying to solve might be the best way. You can optimise the product or service based upon changes to the profile of the customer you are trying to serve.

This can involve conducting surveys, running a focus group, checking on keywords, and accessing public data.

To start this process, you need to understand more about your prospective customer. And to do that, you build a Customer Avatar. Here’s a detailed look at what you need to create a Customer Avatar.

Competitors

Your new business will not exist in a vacuum. Every business has competition. Even if you are a startup (so a zero to one), the customer has some alternative solution that they are already using. But, it may not be perfect for their requirements. Competition can also mean they choose to do nothing at all!

If you don’t work through this process thoroughly, you may miss something which could be critical to your future success. While we’re here, it’s worth pointing out that competition isn’t really part of YOUR business model. It’s part of the environment in which you design your business model. Your competitors are outside of your control. This analysis is done for awareness. So you can identify what a prospective client will be comparing when looking at your business.

We have put together a Competition Worksheet as part of The Lab Course that helps identify the key things to look at when reviewing your competitors. You can go as deep as you want. If there are other things that you want to capture about your competition, now is the time to add these markers to the list. Make sure you capture the same information across all competitors so you are comparing apples with apples.

To make the most of understanding your competitors, you would want to take a good look at a minimum of 10 of your top competitors.

Know your Value

To do this you need to know your Value Proposition. What’s that? A Value Proposition is the promise of value that will be delivered by your business to the customer. It is a statement that answers ‘why’ someone should do business with you.

This is a way for you to develop clarity about how your products and services create value for the customer. It’s how you fix the things that matter to them.

A good value proposition can give you an advantage over your competitors. It is often what your prospects use to evaluate you. For many customers, your value proposition is the first thing they encounter when exploring your brand.

There are 6 elements to your value proposition. Combined these should describe how your product or service helps customers solve problems, what benefits customers can expect, and why customers should buy from you over your competitors.

The thought that you put into this activity and building your Value Proposition will simplify a lot of future key decisions. The best part is that while you are beginning to develop your new business, you can always revisit your Value Proposition to widen (or narrow) the scope of your business as you progress.

How do you turn this into action? Work through these steps…

1. Create your Customer Profile using the sixty:forty Customer Avatar Worksheet

You can use this worksheet to capture information about the person or business that will likely buy from you.

2. Get on the Internet

Search for information about your likely Customers and Competitors. There are several useful tools and a bunch of existing studies about these groups that you’ll be able to use to build out your research. You can also check out social media, community groups, forums, and blogs.

3. Ask Questions

Interview your prospective clients and customers. Don’t go the comfortable route of only talking to family and friends. Step out, jump on social media and look for your avatar and ask them for a chat.

You’ll want to know what they currently do now (in the context of your new business products and services) and where they get the product currently. Find out what’s good about the current solution, what could be better and what their biggest challenges are relating to your offer.

Ask open-ended questions and listen more than you talk.

If you are comfortable in front of people then you could run group sessions, such as a workshop or focus group.

Or you can run surveys, where you get to ask a lot of people the same question. This can be the start of your marketing campaign as well. Names and contact details can be collected so that you can let them know about your prospective launch when you do kick the business off.

Value Proposition: Step by Step Process

To consider your value proposition, ask yourself:

- What is your likely Product or Service?

- Who is your customer (or customer segment)?

- What is the Job to Be Done?

- What Outcome are they looking to achieve?

- What Outcome are they looking to avoid?

- Do you know the competing Value Propositions to your own?

Competitor Analysis: Step by Step Approach

1. Create your Competitor Profile using the sixty:forty Competitor Profile Worksheet

You can use this worksheet to capture information about your competitors to develop a better understanding of the value that they are providing.

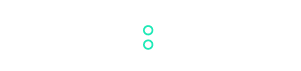

2. Build a Comparison Chart

Often your competitors will have niched themselves. They will be operating in different parts of the market. Some competitors might be premium. Others might be competing on price. There might be geographic targeting or preference based upon demographics. Your objective is to map out these differences and build a comparison chart so that you can see where you will fit.

3. Find your Fit

You know your likely client. You know your value proposition. What differentiates you from the competition? What’s your “Unique Selling Point”?

Create a Competitive map (or a positioning/perceptual map). This is a visualisation of the competitive position of different firms, brands, products, services, or locations on a basic graph.

Why take time to do this?

In short, it’s because you don’t want to waste a lot of time, energy, and money on an idea that won’t get there or end up a commercial success.

Doing extra research at the start allows you to improve the idea or find new options for tackling the problem. It helps you plan at the paper stage and test your concepts for real life buy-in.

Market Research doesn’t need to be expensive

Researching your market offers major benefits, but it can often come at a large cost. And honestly, it isn’t necessary to spend a lot of cash to get this done.

There are a lot of steps that you can do yourself, for very little cost.

Last Word

Research like this will let you compare your expectations with reality. Competitor analysis gives you more information surrounding your future business, including the strengths and weaknesses of your idea. This allows you to understand where you can fit in the market.

By matching this information with your preferred customer avatar, you can identify the type of messaging that will work as you begin to communicate with your future clients.

Don’t sit at this stage too long though because you don’t want information overload. Test what you need to initially validate your idea and then move on. As you move forward, you will likely come up with extra things to experiment with or identify different key assumptions that will affect the idea.

Next Steps

Once you have confidence in the preliminary assessment then you can move onto Chapter 3: Prepare a “Starting Out One Page Plan”. Here you will learn how to write a business plan that covers the important things lightning fast!

Want to download this guide to read later?

Download your PDF version here.

STEP THREE

Prepare a “Starting Out One Page Plan”

Planning is priceless; the plan itself not so much. The point of a plan is to create a road map for your business that shows all the important details about your business and where you want it to go. And ideally, this will be done all on just one page.

What is a Business Plan?

Planning out your business in advance gives you direction and helps to keep the business on track. A business plan is a written document that describes in detail what the business is all about. It defines its objectives and how it will go about achieving its goals.

| Company Overview | Details of your Products & Services | Market Analysis and Competition Summaries |

| Sales and Marketing Plans | Management Plan | Team |

| Milestones and Progress Reporting | Operation Plans | Financial Plans |

The document may also include references to market studies and have attachments such as spreadsheets.

Traditionally, this document describes key elements about the business including:

Why do you need a business plan?

There are a few different reasons that you might need a plan. These include:

- To explain a Business Idea

- For use as a Lean Management tool

- To obtain Traditional Financing

- For Prospective Investors

Writing a business plan helps formalise your idea in writing and it gives you the start of a blueprint for acting on those ideas.

The benefits mostly come from the thinking process that supports its writing. It is here that you consider all the elements that make up your business and its model of operation.

What is the answer?

The answer is your plan should be as short as possible.

There are several reasons for this, but the biggest reason is best stated in a quote from Steve Blank:

“No business plan survives first contact with customers”

This means that while your key assumptions and the details about your idea are great, they will often change when put in front of customers.

The first draft of a plan like this should take less than one hour. This is where you capture the details of your customers, competitors, how you will make and spend money, and begin to lay out your value proposition. As you write this down, it helps you develop clarity in your thinking about your new business.

The objective of a one-page plan is to keep the points short because then you must use laser-like focus on what you are writing about.

What needs to go into a one-page plan?

We will use some of the information that you wrote down from the previous chapter to start building the plan. What you are looking to document includes:

| The Problem you are Solving | How you will Solve It |

| Your Value Proposition | Your Target Market |

| Sales and Contact Channels | Milestones |

| Team | Key Partners |

| Revenue Streams | Cost Structure |

If you are looking for Funding, then some of this information may be switched out for the following:

| Funding Needed | Financial Projections |

| Competitors | Sales & Marketing |

You may not have all this information right now but as you work through this and the next few chapters you will start getting together what you need. Then you can easily update this plan as the information comes in.

What goes into a long-form business plan?

You might still be thinking to yourself that you must prepare a long-form business plan. The bigger the risk that you are taking, or you are asking investors to take, the more comprehensive you want your plan to be.

Two major reasons why you would not want to create a big plan on the first pass would include:

- When you ‘sell’ a big business plan to investors, they are ‘buying’ your plan and expect you to implement it as it is. Even if that plan turns out to be wrong.

- When you have put a lot of time and energy into a long-form plan, you are less likely to discard it when some of your key assumptions fail. This is what is known as the sunk-cost fallacy.

A long-form plan addresses many of the same things as a one-page plan. The main different is that the information will be much more detailed and contain fewer assumptions.

This means that you will have tested the assumptions, and they are more likely to hold. To have validated these assumptions, you will have spent time and money to research and develop evidence on matters like:

| Costs | Market size |

| Preferences | Competitor maps |

The more comprehensive the plan, the more likely you will need a professional advisor to assist with completing all parts. This is because there is a greater reliance on the document and the demand for accuracy will be high. Most investors will be interested in the money side of the business. So, you will often need an accountant or bookkeeper to assist with the preparation of the financial forecasts and budgets.

To give you an idea of what goes into a long-form business plan, here is a general summary of content headings:

- Executive Summary

- Company Overview

- Products & Services

- Market Analysis and Competition Summaries

- Risk Assessments

- Sales and Marketing Plans

- Management Plan

- Team

- Milestones and Progress Reporting

- Operating Plans

- Financial Plans

- Appendices and Exhibits

What can go wrong with writing a business plan?

Several things can go wrong with a plan. Some of the more common mistakes to avoid include:

- Writing the ‘wrong’ style of plan for what you need

- Underestimating how much money it will take to get started

- Being too reliant on only one or two major customers or suppliers

- Being too optimistic about sales growth in forecasts

- Building unrealistic financial projections

- Relying on sketchy research not verified by reliable sources

- Not including any contingencies in budgets for cash and time

- Including too much information

You will notice that a lot of these relate to the finance of the business. There is nothing worse than starting a business underfunded, as it is always very difficult to get back in front. So being realistic at the outset about the finances will always put you in a good place.

The last point to make is that with a long-form business plan you should ask several people to review your plan before submitting it. Another set of eyes can help you identify things that you might have overlooked. These can be things such as spelling mistakes, grammatical errors, or cut and paste issues with consistency.

Now you should have a clear idea of what sort of plan you want to build. We hope we have sold you on the idea of starting with a one-pager until you start to get some validation.

Next Steps

In the next chapter, Chapter 4: Products and Pricing, we are going to take a look at the types of products you will offer and give you some ideas about pricing strategies.

STEP FOUR

Products & Pricing

Products and pricing go together like two peas in a pod. You cannot have one with the other.

Pricing is an art and not a science. There is no ‘one size fits all’ formula for it. But it does start with what you sell.

Products

To understand pricing, you need to be clear about the products and services that you are going to sell.

We won’t spend a lot of time on this as you already have an idea in mind.

This means that you have already started to define the product or service that you will sell through your business. In the sixty:forty Defining Your Solution Worksheet, we have included a worksheet to complete. Here’s 6 things to consider when defining your solution:

- Title (or Name)

- Description

- Price

- Delivery

- Timing

- Type

Having a clear understanding of what you are selling means that you can start to put together early cost estimates of how much it will cost to deliver your product or service.

You can then use this information to get an idea of just how much you need to sell to make your business viable.

Rule #1: The first rule of business is to make a profit. To do this, you need to sell your products or services for more than they cost you to produce them.

And that means that you need to know what they will cost to produce.

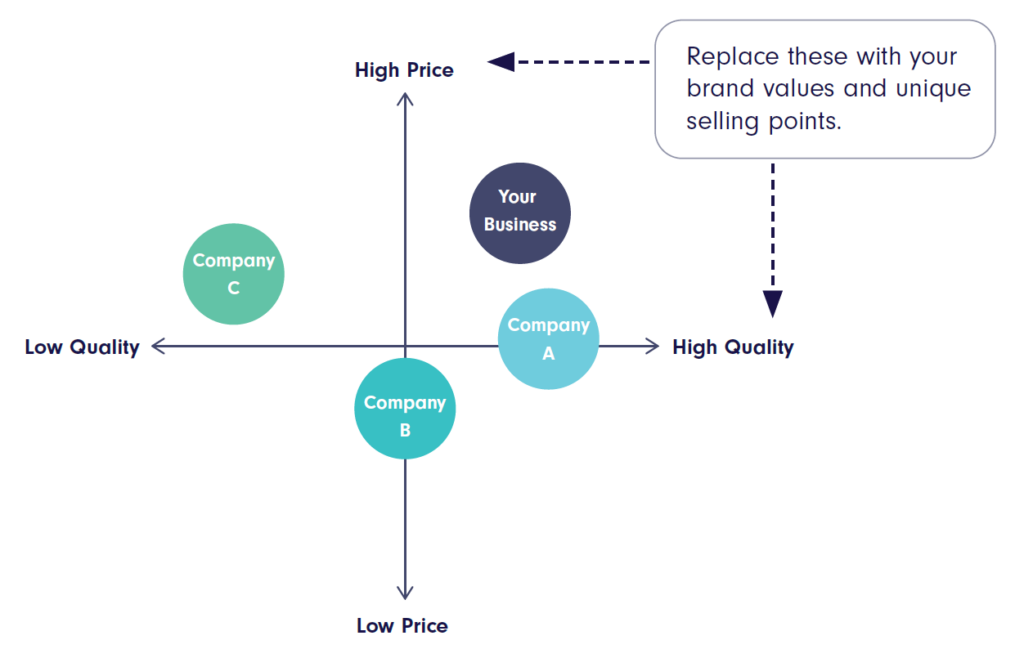

How do you calculate Cost of Goods Sold (COGS)?

There are generally two baskets of business costs: variable and fixed. Anything that you spend to deliver your goods or services to your customer will be treated as a Cost of Goods Sold (COGS).

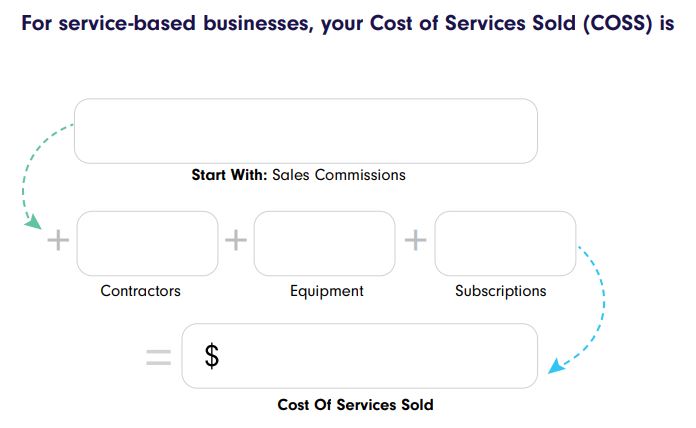

If you provide services, then this becomes your Cost of Services Sold (COSS). These will be a variable cost. This is because the actual amount you spend on COGS (or COSS) will go up and down depending upon how much you sell.

There is a question about whether to include labour in COGS. We believe that you do not include it. We won’t explain why here, but if you do want to know, just reach out to us to ask!

Your other expenses will generally be those that don’t directly relate to producing a product or delivering a service. If you are unsure, just ask yourself

“Do I have to pay this expense even if I don’t sell anything?”

If the answer is yes, then it is more likely to be a fixed cost and not part of your COGS.

Why is it important?

Calculating your COGS is an essential part of your pricing strategy. Here’s a couple of ways that you will use this:

- COGS is used to calculate your Gross Profit Margins.

- It can be used to work out your target breakeven unit of sales

- Pricing decisions will be more accurate

- You can identify production efficiencies

Methods to Calculate Pricing

OK, we’ve talked about your products and your costs to produce them.

Now, let’s talk about pricing.

A pricing strategy is a method that you use to establish the price for your product or service. The goal is to meet consumer and market demand whilst still looking to maximise profits.

You might be wondering why we have spent so much time calculating the COGS. Although your expenses shouldn’t drive your pricing, it must be a consideration. Remember Rule #1 above.

There are many different pricing methods that you can use. We will highlight a few different types here, but remember that you can pick and choose your methods or try them on and see what works.

Cost Plus Pricing

This involves calculating all the costs relating to a product or service and then adding a target markup rate. Markup is the rate of return e.g., cost plus 20%.

Competition Driven Pricing

This is where you review the prices of your various competitors. Refer to your research from Chapter 2. Then you can either:

- Charge a bigger price if you have a better offer. Better is relative and is viewed from your customer’s perspective. So, a premium proposition could be a greater convenience or a concierge-driven product or service.

- Consider price matching with a competitor if you are in a commoditised industry. If you choose this, consider the reason behind why the customer should do business with you. Cutting prices is a race to the bottom. Ideally, you want to have a proposition that has your customer comparing apples and oranges.

Bundled Pricing

This is where you put together two or more complementary products or services and sell them for a single price. The bundled price is usually less than the price of the individual units. Although the overall profit margin is lower, you would expect to sell more products to make up the difference.

Hourly Based Pricing

This is a form of pricing commonly used by consultants, freelancers, and contractors. This is essentially trading time for money. The calculation of the hourly rate needs to take into account productivity and all expected costs.

Calculating how much your time is worth

Here is a way to calculate the value of your working hour. Remember all of your fixed costs will need to be factored in on top.

Project-Based Pricing

This is a fixed price model that charges a flat fee per project. This model is suitable when project requirements, specifications, and scope are well defined. It is generally used by consultants, freelancers, and contractors on specific types of projects.

Value Pricing

This pricing model is used when products or services are priced based upon what the customer is willing to pay. It is driven by what you can charge for the product based upon the perception of value. This is one of our favourite pricing methods. What you charge aligns with the value that is gained from achieving the objectives of the product or service. There are clear, measurable objectives and achievement of these is a win-win outcome.

Retainer Pricing

This is a regular, pre-set billing fee covering a set time or volume of work. There are two types of retainers: rolling and ‘use it or lose it’. You can set your retainer pricing in several different ways.

Dynamic

If you’ve used Uber, then you’ll be familiar with surge or demand pricing. It’s a flexible pricing strategy that fluctuates based on market and customer demand.

Other pricing strategies include launch pricing, psychological pricing and geographic pricing.

So, which should you use?

You need to use the one that is most appropriate for you. There are positives and negatives to each type of pricing strategy and there is no one ‘right’ way.

Mistakes to Avoid

If you don’t optimise your pricing to extract the maximum price that the market is prepared to pay, then you are leaving money on the table. Here are the more common mistakes that we see when pricing:

- Basing prices on costs, rather than on what the market is prepared to pay

- Believing that the marketplace must dictate pricing

- Applying the same profit margin across different products

- Letting commission-based salespeople determine the price at which goods are sold

- Failing to increase prices

Optimising your Pricing

Pricing will influence both your sales volume and your profit margins. These are two levers that you can pull in your business that will ultimately affect how much money you can make.

Although you will set your prices at the start, understanding the ‘best price’ will be a matter of discovery. It is a trade-off between maximising revenue and profit and ensuring enough products are sold to cover costs.

This is one area where you should reach out for expert help. Accountants and bookkeepers have the skills and experience to understand and review your numbers.

Next Steps

Now you will have a better understanding of your products, costs, and pricing. You will need these as we move into the next chapter which is all about small business budgets: Chapter 5: Build a Budget and Forecasts.

Want to download this guide to read later?

Download your PDF version here.

STEP FIVE

Build a Budget & Forecasts

You have a plan and you know the products and services that you want to provide. Now, it’s time to start checking on the financial viability of your business idea. Working through the process of budgeting and forecasting gets you really thinking about your business in advance.

What is a budget?

A budget will give you an overview of the finances in your small business. It is all about predicting how much money will come in and go out of your business over a period of time. When starting out, it is easier to create a budget monthly for a rolling 12 months.

You’ll want to know that the hard work that you are putting in is going to pay off. Putting together a budget will help you see whether you can afford to start the business, and the expected time to pay off given your assumptions.

Why do you need to do a budget?

Budgets are predictive by their very nature. This means that you are making guesstimates about certain things. To make it useful you want to have as much ‘hard data’ in there as you can. This is usually much easier with expenses as you know what these will be. For a new business, it is much harder to estimate your sales growth.

Going through this process gives you targets. It helps you think about how to tie your operations to your business goals and encourages you to make good business decisions.

When you are starting out, you need to know:

- How much will it cost to get everything set up?

- Knowing your products, how much do you need to sell to break even?

- How will your budget influence your pricing strategy?

- Does your budget or show that you will need to borrow money?

How to Create a Budget

The first step is to work out what time frame you want to use. Typically, it will be 12 months. We strongly suggest a monthly plan over a rolling 12 months.

Income

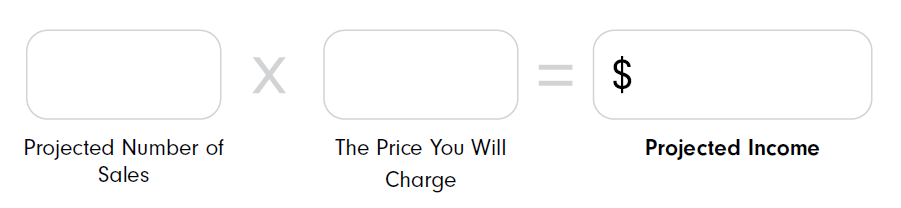

The income side is a little harder to predict with a new business, as you don’t have any data about sales. Once you can establish data about likely sales, then it’s straightforward to calculate the projected income:

Costs

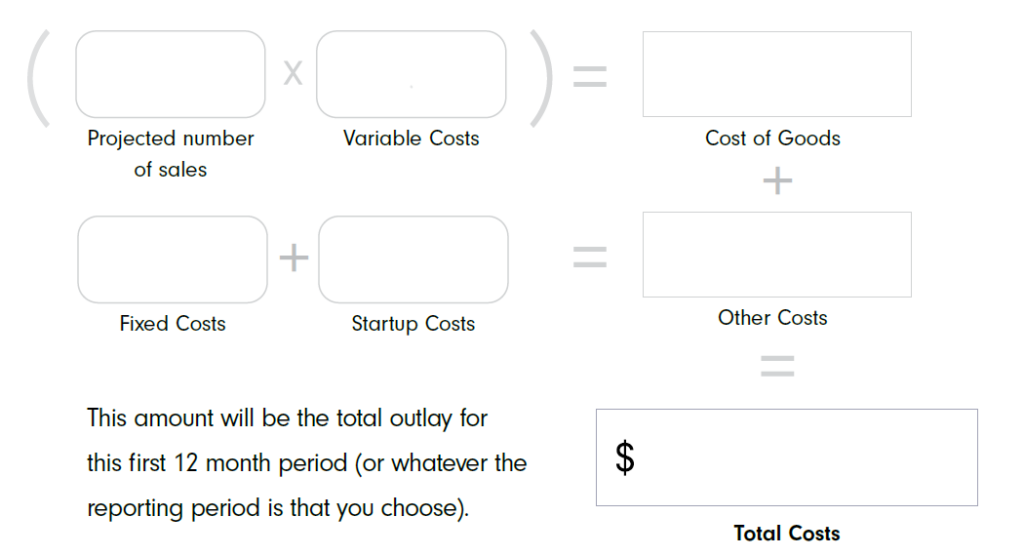

Determining the costs of your business should be pretty straightforward. Costs will be separated into three parts:

Start-up costs of the Business or Project

These are the one-off costs. This is money that you spend before you even open the doors to your business. And as a reality check – when you are starting your business, you can’t expect to maintain a stellar salary. You will likely be asking people to invest in the business with you. Your investors will want to know their investment is going towards making the business work, not just pay your salary.

Variable Costs

These are costs that will go up and down depending upon how much stuff you produce or buy. If you produce or buy more, your variable costs go up. If you produce or buy less, then these costs go down. You must know what these costs are to price effectively.

Fixed Costs

These are costs that will stay the same no matter how much stuff you produce. Examples of these types of costs include rent, administrative salaries, telephone, and insurance.

To calculate your costs properly you will need to know the number of projected sales (in units).

This amount will be the total outlay for this first 12 month period (or whatever the reporting period is that you choose).

Look at the different ways that you can test your idea before you jump in, especially in areas like retail or food & beverage. Try a pop-up store or co-share a commercial kitchen to trial your concept first.

– Sheree Cusack sixty:forty

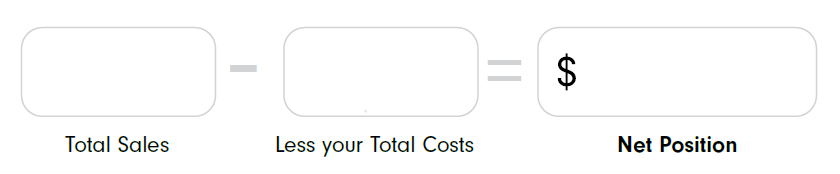

Pull it All Together

When you first see an income and expense graph and there is more red than green, it can be a little gut-wrenching. But it is the reality of starting a business. It is expected that you will start behind as you begin to gain traction, develop clients, and sell your products and services.

What you do need to have is a plan to make up the shortfall. Give some thought to how you will fund the difference. These funds might be from personal funds or loans from friends or family.

Rinse and Repeat

The power in a budget comes in comparing it to actual results. This means that you should review your budget regularly. Our ideal is no more than 3 months between reviews. Preferably, check your budget each month to see if you are on track. There is a lot that can happen in a month, especially in a business that is starting out, so it makes sense to review this often. This process also allows you to update your future budgets and see that your assumptions are holding.

Ask for Help

Budgets put you in control and allow you to make solid, strategic decisions for your new business. Using scenario planning, you can try out different scenarios and see how these variations impact upon your numbers.

Setting a budget isn’t complicated but when you are starting out, it can be helpful to involve an expert. They can run through the numbers, double check them and ensure that you haven’t missed anything major in your calculations. They can also give guidance on realistic assumptions that you can use for sales numbers.

What can go wrong with a budget?

Some of the more common mistakes to avoid include:

- Underestimating how much money it will take to get started and run your business

- Being too optimistic about sales growth in forecasts

- Building unrealistic financial projections

- Not including cash contingencies

- Creating a budget and then ignoring it

- Making it too complicated

- Not provisioning for taxes that need to be paid

Putting in the work to create your budget is worth the effort. Preparing your budget will give you the financial insights you need to make the right decisions as you start, build, manage and grow into the future.

Next Steps

The next chapter will take a look at choosing the right structure for your new venture: Chapter 6: Choose a Business Structure.

STEP SIX

Choose a Business Structure

This is a key decision that you will make when starting a business. This choice will impact how much tax you pay, whether you can sell shares, your personal liability, setup and ongoing costs.

Business Structure

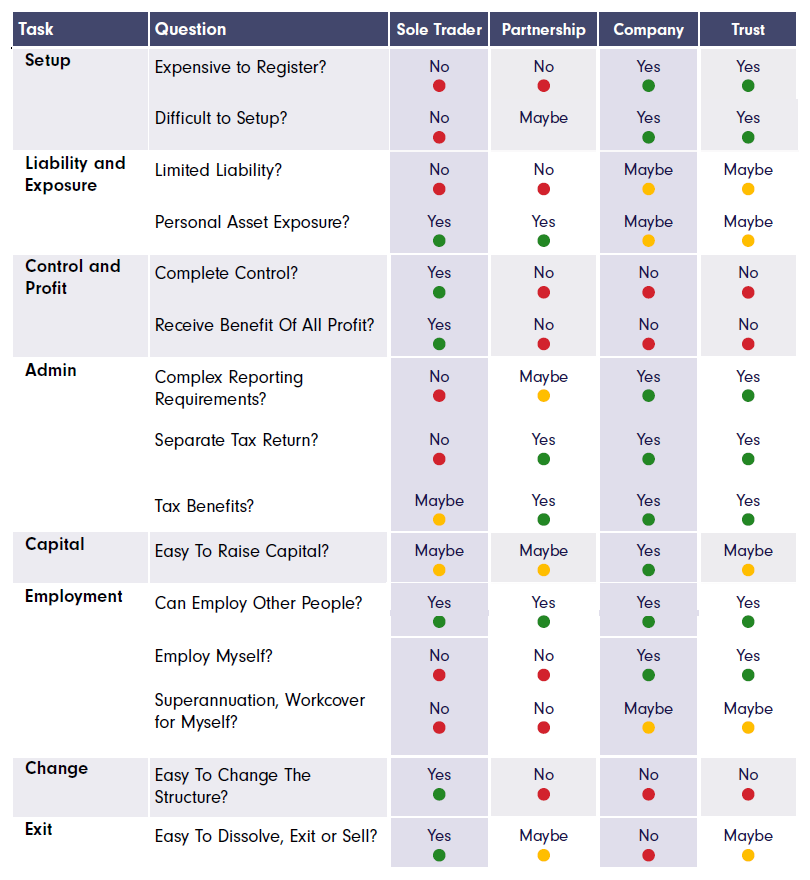

Choosing the right legal structure is a necessary part of starting a business. It is important to understand all your options. In Australia, there are four main types of commercial business structure. These are:

| Sole Trader | Partnership |

| Company | Trust |

There are others such as Co-Operatives or Incorporated Associations but we will not look at these here.

The type of structure that you choose will depend on some different factors including:

- the type and size of your business

- your personal circumstances

- your ability to manage the admin and paperwork, and

- the likely future growth of the business.

If you are starting to get bigger or you’re taking on riskier projects, then it might be a sign that you need to make a change. You aren’t locked into one structure forever. When the business grows or circumstances change, then you need to change as well. This will come at a cost and you’ll need expert guidance, especially where assets and contracts are involved.

It is a great idea to discuss your choice of structure with an accountant, lawyer, or business advisor before starting your business.

Type of Structure

The structure you choose will be the one that has the greatest long-term benefit and reflects the future goals of your business.

Each structure has different upfront and ongoing costs. Tax and access to government programs may also be a factor in your decision. Profits earned by a sole trader are treated as personal income and are taxed as such. Companies are taxed separately at a flat tax rate.

Sole Trader

A sole trader is the simplest form of business structure. You manage and operate the business by yourself, under your own name. This structure is the cheapest and easiest to set up. However, it is not very flexible and all profits are taxed on your personal tax return.

As a sole trader, you have no special legal status. You are the business. This means that there is no distinction between the assets of the business and your personal assets. If the business takes on debt or gets into legal trouble, so do you.

Partnership

A partnership is owned by two or more entities. The partners could be people or it might be a company. Setting up a partnership is straightforward and relatively cost-effective.

The partners choose how the split is to be made and it doesn’t have to be equal. The ‘rules’ of the partnership should all be set out in a partnership agreement.

See our cheat sheet on the minimum things to be considered in a partnership agreement. And as always, you should seek legal advice if you need it.

Getting a properly drafted partnership agreement can be one of the most efficient forms of insurance.

You will need to do a separate partnership tax return. Your share of that net partnership income is declared on your personal tax return. There can be a difference between what you receive from the partnership in cash and what gets shown as your taxable income.

Like a sole trader, a partnership has no special legal status. The partners are jointly responsible for the debts of the business. And actions of one partner will bind the other which means that both partners are equally responsible for the actions of the other. This makes it really important to know who you are going into partnership with.

Partnership Agreement

A partnership agreement sets out how a partnership will operate. The agreement needs to document how ownership and control will be divided between the partners. Once you start asking questions, even a simple agreement can become long and complicated. Putting the correct agreement in place right from the start saves a lot of issues in the long run.

The types of things that you should cover in a partnership agreement include:

- Legal Name of the Partnership

- What the partnership will do

- The full legal names of each of the partners, their addresses, and contact details

- Details about what percentage of the partnership business each partner owns

- Details on the partnership decision-making process

- Details of how and when profits will be distributed

- Processes for managing the bookkeeping, finances and taxation

- The process for resolving disputes between the partners

- A process for how the partnership can be finalised. This includes details on what will happen to any remaining assets or what will happen if there are only debts left

Disclaimer: This is not legal advice and is provided as general information only. It does not take into account your personal situation. We strongly recommend that you get great legal advice in this area.

Company

A company is a legal entity, separate from its owners. This makes it ideal if you are looking to grow and scale your business. Shares in a company can be owned by one person or by many. If there are lots of shareholders, it is recommended that you have a shareholders agreement in place.

A company also has limited liability (subject to certain limitations), making it suitable for higher-risk businesses. This means that individual shareholders are not responsible for debts or liabilities that the company incurs, up to any unpaid amount on the shares (which is normally zero).

Because it is seen as separate, it will pay its own tax and be able to purchase its own assets. The Corporations Act sets out the rules for running and managing a company. There are several obligations that a Director of a company becomes responsible for. There are ongoing annual fees that you will need to pay to ASIC as well.

Trust

You can use a Trust to run a business. A Trust is an entity that holds property or income for others. These people are called beneficiaries. The trustee can be individuals or a corporate trustee. An individual trustee is personally liable for the debts of the trust. Generally, profits are not able to be retained to fund future business growth. All profits must be distributed to beneficiaries, with that share of trust profits to be declared on the individual’s tax return.

These are more complex to set up and you should speak to an advisor to see if this is right for you.

There are very strict rules about raising capital for new business. Make sure you get it right.

Deciding on a Structure

Let’s take a look at these four structures and compare them.

Some people are not allowed by ASIC to manage companies or operate businesses in Australia. This may affect company formations and business name registrations.

From looking at this you might already have an idea of what type of structure might suit you. In the next chapter, we look at exactly how to go about setting up all your registrations.

This information is general only and is not advice. If you have any questions about the right type of structure, reach out to a professional for advice.

Next Steps

The next chapter will take a look at business and tax registrations: Chapter 7: Register Your Business.

Want to download this guide to read later?

Download your PDF version here.

STEP SEVEN

Register your business

When registering your business, it can be confusing to know what comes first. Let’s simplify it with these 9 steps:

- Decide on the type of entity that you are going to set up

- Decide on a Name and check it is available across all required properties

- Establish the Business

- Register for an Australian Business Number (ABN) and any other Tax Registrations

- Register any Business Names

- Arrange your Banking Facilities

- Register your Domain Names and any Social Properties

- Apply for any other licences and permits

- Consider whether a trademark applies

Choose your Business Structure

In the last chapter, you decided on the type of business structure you want to use. Now, we’ll look at what happens next.

Naming your Business

Without going into the whole branding aspect (which is super important, by the way), naming your business is one of those key decisions that will set you up for the future.

Is it really that important? Yes, it is. Your business name helps customers identify your business from others. You will be investing money and time in marketing your business. And if you need to re-name your business at a future point that can create some issues.

Are social media properties important to your future branding? If so, then you will need to ensure that your selected name is available across your chosen platforms.

Checking your name availability effectively is important before you invest anything in promotion or get hit with any legal infringement notices. Especially if it is a name you wish to trademark.

Establish the Business

If you are a sole trader this is easy. You make the decision.

If you are a partnership, company, or trust then the process will need a bit more paperwork. You may need a company registration with ASIC. You may also need to involve an accountant or lawyer to help with this process.

At the end of this step, you will have your legal entity set up and ready to go.

For more resources on this, sign into the sixty:forty platform and check out the forum on the topic.

Apply for an ABN and other Tax Registrations

An Australian Business Number is a unique 11-digit number that is issued to your entity. You need to be entitled to an ABN to apply, and that means you need to be carrying on a business.

Information from your ABN allows customers to check that your registration is current. It is a publicly available number and anyone can check your registration details online.

Not all tax registration types will apply to your business. What you need to register for will depend upon the type of business you are starting, whether you are employing, and your turnover.

If you register your structure through an accountant or lawyer, they may take care of this and your business name registration. Check the scope of works to see who handles what.

The other types of Tax Registrations that you may need to consider include:

- Tax File Number (TFN) – this is a private number that you do not give to anyone but your bank and your accountant. This is a unique number issued to separate entities. Sole Traders will use their personal TFN.

- Goods and Services Tax (GST) – if your income will go over the threshold.

- Pay As You Go (PAYG) Withholding Tax – if you employ people or withhold other amounts such as voluntary withholding or withholding due to no ABN being supplied.

- Fuel Tax Credits – if you conduct eligible activities or operate eligible equipment.

- Fringe Benefits Tax (FBT) – if you provide benefits to employees or associates.

An ABN application made directly via the Australian Business Register (ABR) site is free. If you use the Business Registration Service you can apply for a business name, ABN, and other tax registrations all at the same time.

If you don’t have an ABN, it can prevent you from doing some of these later steps. If you don’t register for an ABN, other businesses who make payments to you must withhold 47% in tax from your payment.

Registering a Business Name.

A business name is a name under which a person or entity operates their business. This step is only necessary if you are going to trade with a name that is different to your own.

You make the registration through the Australian Securities and Investment Commission (ASIC). This is a national registration so will cover use in all states.

A sole trader operating as their own name, or a company operating as their own name will not have to register. Practically everyone else needs to register a business name.

Example

| John Smith | doesn’t need to register |

| John Smith Mowing | does need to register |

When going through the registration process it is easier if you already have an ABN or have applied for an ABN. Make sure you have either the ABN or application number handy.

Just because a business name is available doesn’t mean it isn’t being used in other ways. So, make sure you have used the Name Availability Checklist.

Arrange your Banking Facilities

Business is all about making money and to be able to access the cash, you’ll need transaction bank accounts. To open the account, you will need the documents you created when you established the business or company.

Exactly what you will need is dependent upon your chosen bank. At a minimum, they must verify the new business entity and any trading names so be sure to have all those documents ready.

You may have to make an appointment with your bank to open the account. The point of this account is to be able to receive funds and spend money. You may also choose to use a credit card for paying some of your business expenses. And you may even be looking to apply for a loan.

For simple affairs, some of the banks can open business bank accounts online.

If you’re not sure, talk to your bank about what account type is right for you.

You might also consider how you will accept payments from customers. Are there any third-party companies that you might use instead of a bank to accept funds? Some of these payment processors might include Paypal, Square, or Wise. Your choice here will depend upon many factors including whether you need access to banking facilities like:

- Merchant Facilities (Offline)

- Merchant Facilities (Online)

- International Transfers

- International Bank Accounts

- Ability to obtain a Loan

Register your Domain Names and any Social Properties

Your domain name is your address on the internet. It can be a valuable part of your business identity and will help customers find your business. You will need to pay to get this setup, which is why you need to have your bank accounts sorted out first.

You can register the domain even if you don’t have a website yet. This ensures that this name will be available when you need it.

If you get other people to help do this for you, make sure you get the details, passwords, and logins for your accounts. This way you can access and manage this yourself if needed.

Once you have your domain, identify the different social platforms that you want to use and set up accounts for each of these under your chosen name.

Apply for Licences and Permits

The type of licences and permits that you need to operate your business will vary. This depends on the industry that you operate in and the location of your business.

You can use the Australian Business Licence and Information Service to find the licences that you need to start and run your business.

This is an incredibly useful service as it covers federal, state, and local government authorities. The service can help identify the type of licences and compliance requirements that you might need. The relevant links are also provided so that you can take care of the applications and registrations yourself.

Trademarks

Just because you have a business name, doesn’t mean that you have exclusive ownership of the name. Just as it doesn’t prevent other people from being able to register and use similar names to yours.

It is your responsibility to ensure that your chosen name doesn’t infringe on someone else’s trademark as well. This can be easily checked and is done at the ‘Naming your Business’ stage.

If you want to apply for a trademark then you can do this through IP Australia or use a local expert advisor.

While it may seem straightforward, there are several issues that you need to consider. Making the wrong choices with your application can be costly – in dollars and in time. Ensuring that you register your trademark under the right class is essential to having the right level of protection.

As with most things, if you are in doubt chat to an expert. The person you need for this will be a commercial lawyer with experience in trademarks or intellectual property.

Other types of intellectual property rights may apply to your business as well. Talking with an expert in this area will highlight all of these for you.

Next Steps

In the next chapter we are going to take a more detailed look at your legal obligations and protecting your business through pre-planning – Chapter 8: Legal Obligations and Protecting Your Business.

STEP EIGHT

Legal Obligations & Protecting Your Business

Depending on where you are and what structure you choose, there are legal obligations that come with starting a business. These include registrations for your chosen business structure, licences and insurance – just to name a few.

You don’t want to build your business up to lose it. Protect your investment by planning ahead.

This guide is not a comprehensive statement of the law and if you have any questions, you need to contact a lawyer to discuss your specific matters.

Legal 101

As a small business, you will have several legal obligations that you need to take care of.

Ignorance of the law does not excuse.

This means that just because you don’t know about it, doesn’t mean that it doesn’t apply to you. It is your responsibility to understand what might impact your business. You aren’t expected to know everything yourself, but you can build a team around you to help you understand your risks and obligations.

Various people can help you out in this space and the types of professionals that you may get help from include:

- Lawyers

- Insurance Brokers

- Risk Management Consultants

- Workplace Health and Safety Consultants

- Accountants

Regulation

Many industries are subject to regulation and oversight. These can include state-based administration such as Property, Motor Industry, Security, Tattoo, Auction, Second Hand Dealing, Debt Collection, and Personal Services (like matchmaking).

There may be other Federal compliance requirements as well. An example here is ASIC which is the corporate, markets, financial services, and consumer credit regulator.

Ordinarily, regulation is driven by the industry that you work in, so check out any available industry resources. Many are available online for easy access.

Fair Trade

Fair trading and consumer laws are there to protect you, your business, and your customers.

Some things to consider when setting out your business practices include:

- Avoid misleading your customers about price, quality, and value

- Avoid making false claims about products or services

- Avoid making false representations about indigenous souvenirs and artwork

- Avoid unfair business tactics

- Avoid illegal selling methods

- Be truthful about country of origin claims

There is an excellent resource put out jointly by the states that includes a checklist for you to apply to your own small business. The Small Business Self Assessment checklist can help you understand which parts of Australian Consumer Law may apply to your business.

This is not a complete list and you should check with your lawyer to see what other things might apply.

Privacy

In Australia, you need to consider the Privacy Act 1988. This is administered by the Office of the Australian Information Commissioner.

Consumers have privacy rights and these need to be protected by the business. Most websites are required to have a Privacy Policy that tells people how you will be using their private information.

Most small businesses are not covered by the Privacy Act 1988, but some are. For this exclusion to apply, you must have an annual turnover of $3 million or less.

If you aren’t sure whether this may apply to you, you can use their 15-question checklist as a self-assessment. Make sure you keep a printout or electronic copy of your responses so you can demonstrate that you did check whether this applied to you or not.

You can also discuss this with your industry association or your lawyer.

Understand Contract Basics

Contracts are an everyday part of small business life. To ensure business runs smoothly, it is essential to make sure that your contracts are in order.

Some of the different types of contracts you might need include:

- Terms and Conditions of Sale

- Client Agreements

- Contracts with your employees or contractors

- Shareholder Agreements

There are many online template-based legal service providers. But buyer beware – if you are going to download something for free off the internet, you must make sure it is fit for purpose and covers Australian law. We do have some Australian-based template companies, such as LawPath and LawDepot to name a few. You can find links to these on our site.

If you do use these, you are taking a risk that it just isn’t quite right for your business needs. Then the question becomes, ‘Do you want to run around looking after this?’

Your time is probably better spent working on getting your business up and running, so look to hire a commercial lawyer to give you a hand.

This is one area where money spent up front can save you a lot of time and money later on if you find that you don’t have the correct contracts in place.

Don’t risk everything you worked hard for … Protect it!

Risk management is the process of looking at your business and identifying possible risks. You can then come up with a plan for managing them in advance.

We believe that risk management is asset management. In this context, assets include your time, your people, your physical assets, the environment that you operate in, and your reputation.

A good risk management plan will produce some exceptional results for your business – when it’s done well. This means putting time into effective planning and implementation. Once that is done, take the time to regularly review and monitor your processes.

Some of the benefits of having an effective risk management approach include:

- Minimised reputational risk in the event of an incident

- Minimised likelihood of contract dispute

- Reduced exposure for legal action

- Reduced risk of loss

- Reduction in the time spent dealing with incidents or business downtime

- Maximised profits by avoiding re-work

- Likelihood of lower insurance premiums

A lot of the words used here are about minimising the impact of issues. And that’s the key point. You’ll want to use these processes to reduce both the direct and indirect risks and recognise the impact of consequences if something were to happen.

Protect your Intellectual Property

We discussed trademarks in the last chapter on registering your business. Now we are going to talk about Intellectual Property (IP). Managing your IP properly can allow you to protect your ideas both here in Australia and overseas.

Protecting your IP is more than just registration. There are numerous tasks that you must do to maintain an effective registration. This is a specialty field with many strict rules, so getting professional advice is essential to ensure you are truly protecting your asset.

If you believe you have an idea that is eligible then you must get expert help in the form of a Patent Attorney.

Get the right insurance

Insurance just might save your business someday in the event of a worst-case outcome. And some of your customers may require you to have a certain type and amount of insurance cover in order to do business. Some professional registrations may also require a minimum level of cover.

Let’s take a look at the main types of insurance policies that you might need for your business:

| Business Continuity | Key Person |

| Professional Indemnity | Property |

| Public Liability | Workplace Health and Safety / Workers Compensation |

The insurance requirements for every business will be different and this is not an exhaustive list.

While you can organise this coverage this on your own, you can save a lot of time by working with an insurance expert. They can help you arrange the cover that you need and do the legwork to find the right cover at a reasonable premium.

Manage Workplace Health & Safety

Workplace health and safety laws seek to protect workers when they are at work. If you have employees (or people who fall under the extended definition of employee) then you will need to have cover.

You can discuss this with your accountant or contact your state’s workplace governing body for more information.

To close out this topic, once again, this guide is not a comprehensive statement of the law. If you have any questions, you will need to contact a specialist to help you out.

Getting this foundation right from the start is an investment in the long-term future of your business. So take the time to get it right.

Next Steps

In the next chapter, we will be looking at the critical things to consider when building your team. Chapter 9: Build Your Team.

STEP NINE

Build your team

Business and investing a team sports. So the question then becomes – Who’s on your team?

Bringing a team together is one of the most critical things that you will do in building your business. Your business is built with people and the sooner you understand this, the faster you will achieve your business goals. When structuring your team, we recommend using a functional organisation chart. This approach can help you to fill the gaps in your business.

Your team can be brought together under various arrangements, such as:

- Employees

- Contractors

- Outsourced workers

- Virtual assistants

- Third-party professionals

Your team is whoever you need to make things happen for your business. You need to be able to surround yourself with trusted and reliable people.

And when you are starting a new business or new division, there are key team members that you will need to bring on. We call these people your Dream Team.

The Dream Team that you build will depend on the type of business that you are starting. There is no one-size-fits-all approach.

We have put together a starter list of who might make up your Dream Team. Your requirements depend upon whether you are starting out, starting up, looking for stability in your business, or looking to scale.

So, I’d like you to now ask yourself, “If money were no object, what is the perfect service-based starting team that I would put together?” Would your team include professionals like:

- Accountants

- App Developers

- Brand Creators

- Digital Marketing Specialists

- Grant Writers

- A Lawyer

- A Marketing Strategist

- Web Designers including UX and UI

- Web Developers for Front End and Backend

Teamwork makes the Dream work

How can you work with and through others to launch your business or product?

Next Steps

In the next chapter we will be looking at business finance, including alternative commerce considerations in Chapter 10: Financing Your Business.

STEP TEN

Financing your business

When you start thinking about finances, it can quickly become a little overwhelming. Yet, this is one point where having the right person in your team can make things easier.

No matter how awesome your business idea is, you need capital to start and grow the business. Funding a new venture is rarely easy and will generally take longer than expected.

Right now, you might be thinking that you can only finance your new business with your own cash or by borrowing from family or friends.

I’ll let you in on a little secret … there are other options available.

But before you rush into building that killer pitch deck, consider these eight questions:

- How much do you need?

- When do you need it by?

- What are you going to spend it on?

- Do you expect to pay it back?

- Do you need it in the short term or for the long term?

- What is the cost of getting the funding?

- What are the terms on offer?

- What are you prepared to give up, to get it?

There are two major ways to finance your business: debt or equity.

Debt is where you borrow an amount of money and have to pay it back, usually with some type of interest. Repayments can be fixed or flexible. They might need to be paid each month or perhaps it is all paid back at the end of the agreement.

Equity is where you raise funds from selling a share of your business to investors.

There are a lot of options in between and it isn’t always a simple choice between one or the other. You may end up with a mix of different types of funding as you start and then grow your business.

Whichever way you choose to go it is important to find a funding option that suits you.

When you are just starting out, you may find that your financing options are limited. This is simply because there is little trading history behind you. You might need to then rely on personal security to get your deal over the line.

Not all financing products are created equal. Sometimes having a finance specialist guide you will make it easier to find the right fit. This is one of the great reasons why building your team is important. A strong network goes a long way when you are looking to launch your business and beyond.

Alternative Commerce

Expand your financing universe and challenge the way things are ‘usually’ done. We asked you before to consider:

What is the reason that you are seeking funding? What are you looking to purchase with the money?

What if we told you that were other ways you can get access to what you need … without cash.

At sixty:forty, we are all about Alternative Commerce and this covers funding and capital. It means looking at different ways that you can pay, get paid and get access to funding.

Imagine for a moment that you had unlimited access to funding. How would that change your approach to your small business? What would you do differently? Who would you like to bring on to build, manage or grow your business?

The sixty:forty platform provides opportunities to:

- Get competitive quotes using our ‘Build a Better Brief’ approach

- Enter into formally deferred payment arrangements that extend well past usual terms of trade

- Explore options with barter

- Find a mentor for guidance or be a mentor for someone else

- Enter into Joint Ventures & Strategic Partnerships to take advantage of investments that other people have already made in the assets of their business

- Look for Co-Founders and Equity investors

- Find those who accept cryptocurrency

Just think of the possibilities. How could any of these help you start and scale your business?

We aim to connect small business owners with service providers and professionals. It is our goal to make it easier to find and put together a great deal that is a fit for you and your business.

In short, Alternative Commerce creates opportunities for Small Business and Startups. But it’s up to you to walk through the door and see what’s on the other side.

This is just a quick overview that barely scratches the surface, but I’m sure you can already see just how involved this could be. This guide is intended as general information only and if you need specific advice, please contact your local professional for help.

Next Steps

The next topic covers the steps you need to take when developing a Go To Market strategy that will support your new business. Learn more about that in Chapter 11: Ready, Set, Go (to Market)!

STEP ELEVEN

Ready, Set, Go (to Market)!

You’ve tested your idea for viability and market demand. You’ve built an awesome product that you’re proud of. You have everything sorted as far as your structure, legals, insurance, and accounting and financing.

Now the question is, “How are going to get your product in front of the people who will want to buy it?”

You answer this with a Go To Market (GTM) strategy. This is the marketing plan that you will use to take your product to the people. It outlines how you are building a bridge between the product or service that your business sells and your customer. Getting this right is essential because if you don’t, you could waste months of time and precious cash.

Even good ideas can fail if not actioned properly.

Having a plan doesn’t guarantee success. However, it can help you manage expectations. You’ll learn whether you’re chasing the right audience with the right message, at the right time, using the right media.

Answer these five questions to begin putting together your plan. If you’ve done the work through the rest of this guide then these should be straight forward.

- Why are you launching your product?

- Who is it for?

- How are you going to encourage people to buy it?

- What price are you going to sell it at?

- How are you going to get it into their hands (your distribution model)?

To build and effective GTM strategy means that you have to be clear about things like:

- What are you offering?

- What problem does your product solve? What are the major pain points you are addressing?

- How can you talk about the value that your product creates?

- What is your niche or target market?

- Who is your target customer? (Asked another way, who are you selling to?)

- Do you have a customer avatar or buyer persona for your products?

- What is the brand positioning?

- What price will you sell the product at? Will you use a promotional pricing strategy for launch?

- What channels will you use to communicate with your prospective customers? How will you make people aware of what it is that you have to offer and move them through the Know – Like – Trust stages?

- What type of messaging will you be using to communicate at the various prospect stages?

- What channels will you use to communicate with clients?

- What is your sales process?

- What distribution model(s) will you use?

- What are the assets that you need to have in place to support the channel and sales approach? For example, do you need a website or e-commerce facility, and if so, why?

These answers aren’t set in stone. You may find that once you take the product to market you need to adapt and upgrade some of your thinking or assumptions. This is using feedback to your advantage. You need to continue to tweak and make changes to optimise, reduce the cost of customer acquisition, and shorten lead times to conversion.

To build a great business, you will always need to be learning and adapting.

Now that your business is officially up and running, you might find that there are times when you might need some extra help and are not sure where to turn. Where to find this help is what we’ll cover in the next chapter.

Next Steps

Looking for some extra support to begin your small business journey? Reach out to us on any of our social channels or jump online and ask questions in our community forum. Find out how in Chapter 12: Get Extra Support.

STEP TWELVE

Get Extra Support

Congratulations on your first big step in getting your business launched. But the work is only just beginning.

Now it’s time to move into the build phase. Here at sixty:forty, we have resources and solutions to help you out at all stages of business.

We have lots of free stuff that you can get access to when you sign up including guides, templates, and checklists. Membership is open to anyone in small business. This is for you no matter where you are in your small business journey. You may be thinking about going into business, have an existing business, or provide services to small businesses.

And you can begin your membership for free.

In case you haven’t noticed … we love small business and want to see small business owners succeed.

sixty:forty is built by small business owners for small business owners.